Principal

Citygate Associates, LLC

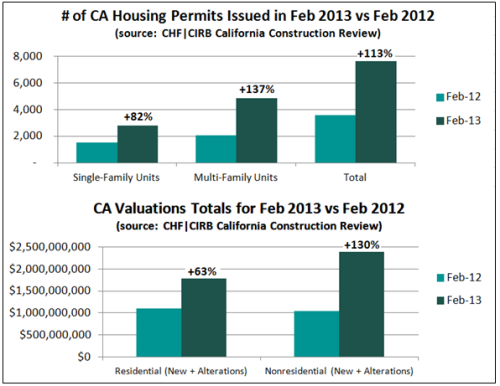

Demand for housing throughout California is once again on the upswing. Inventories are down and buyers who have been sitting on the sidelines are now jumping back into the market. Experts agree, and buyers believe, that the California housing market has bottomed out. Interest rates are at historic lows and are expected to remain low for the next several years, according to Fed Chair Ben Bernanke.![iStock_000003535509Small[1]](https://citygateassociates.files.wordpress.com/2013/06/istock_000003535509small1.jpg?w=500&h=332)

The competition among home buyers in California has been intense: 9 out of 10 homes sold in San Francisco, Sacramento and cities in Southern California drew multiple bids during the month (of March). (CNN Money, April 5, 2013)

Metrostudy, a national housing data and consulting firm that maintains the most extensive primary database on residential construction in the US housing market, recently reported (May 8, 2013) that Northern California annual housing starts are up 82% from the first quarter of 2012, while closings are up 48%.

Steve Johnson, Regional Director of Metrostudy’s Southern California, Inland Empire and San Diego markets said, “Home builders are staffing up and searching the market for sites which they can rapidly bring to market for new subdivisions…”

Steve Johnson, Regional Director of Metrostudy’s Southern California, Inland Empire and San Diego markets said, “Home builders are staffing up and searching the market for sites which they can rapidly bring to market for new subdivisions…”

Ask Your Staff if They’re Ready to Provide Quality Customer Service as Demand for Permits Increases

Community development, planning, and building departments in California have been decimated since the recession of 2008. At the recession’s lowest point, many senior highly-experienced staff members who could retire did so.

It just wasn’t pleasant or satisfying to stick around for the bloodletting as cities and counties suffered through layoffs. Moreover, many agencies offered attractive incentive programs to induce early retirements. As a result, many local government agencies are not in a good position to manage, much less lead the way, as the housing and development markets begin to fire up. Those staff members that do remain are often less experienced, less confident, and less organized.

The World Has Changed Since September 2008

Think back five years. Google was still out to find its position in the marketplace; cell phones were being used but were not that “smart”; and Kodak was still in the film business. Only the very young were texting one another and PDFs were pretty much reserved for technology-savvy users. Social media? What was that? Facebook was still in a negative cash flow position in 2008 and half the world had never heard of it.

Improvements in technology allow the private sector to provide choices to the consumer that they didn’t have five years ago. Just click, and you’ve got it!

The private sector has figured out how to provide excellent customer service, day in and day out. When you call a customer service line nowadays you invariably hear, “How may I help you today?” or “I can help you with that.” When the transaction is completed, you’re asked, “Is there anything else we can do for you today?” and the call is ended by, “Thank you for calling us and thank you for using (fill in the blank).”

Local governments’ customer expectations with regard to how they are treated by staff have also changed—big time. These high customer expectations present a real challenge to both elected and appointed local government leaders. The public sector operates at a disadvantage: no competition and no profit incentives.

Take Advantage of the Generational Shift

New ways of doing business in the public sector have emerged and have led to a new set of “best practices” for customer service, community engagement, government transparency, and much, much more. The current generation of employees entering the public sector workforce approach problem solving and service delivery with an entirely new set of technology tools. Smart cities and counties are learning how to take advantage of these new resources.

Citygate’s Team Can Get You Ahead of the Curve on Quality Public Sector Customer Service

Citygate has a proven track record of helping cities and counties establish “best practice” development permit review systems. Applicants and stakeholders of all types and persuasions see the positive changes that result from our Action Plan recommendations.

Our team includes leading public sector authorities on the use of information technology, e-government and social media to make permitting processes and procedures more efficient and effective, to promote civic engagement, and to improve customer service. In fact, later this summer, our very own Citygate Press is publishing a book titled, Customer Service.Gov: Technology Tools and Customer Service Principles for Innovative and Entrepreneurial Government.

We have helped institute customer service and other efficiency and effectiveness improvements in dozens of cities and counties throughout California and the West.

If we can be of value to you, we would like to help. Please contact Jay Corey by phone at (510) 303-0327 or via email at jcorey@citygateassociates.com.

If we can be of value to you, we would like to help. Please contact Jay Corey by phone at (510) 303-0327 or via email at jcorey@citygateassociates.com.